Additional

interesting items on the technology and history

What's on

this page?

Seven

Sisters and

Standard Oil heritage

of major companies

Oil

Price Chart

Largest

Oil

Producing Countries

Largest

US Oil Fields

Largest

Oil Fields

in the World

Countries

with Large Natural Gas Reserves

Largest Natural Gas

Fields in the World

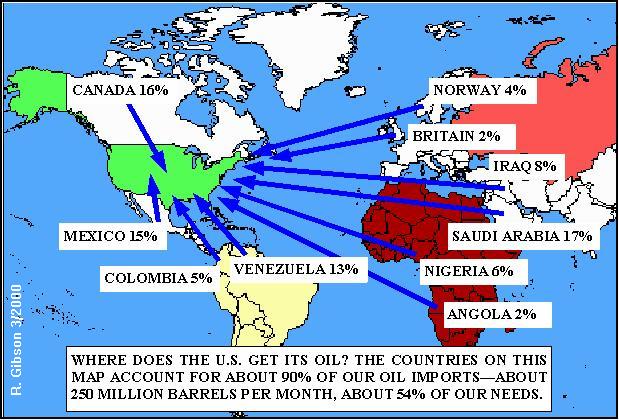

Sources of US Oil

Imports

Where your gasoline

dollars go

Plus

assorted facts

in the text sections

|

NEW: A

map showing the sources of US oil imports has been added

at the bottom of the page, as well as a table showing

where your gasoline dollar goes. There's also a new

link to "Largest Oil Companies," and several items have

been updated.

US OIL

DEMAND, 2004: Over 20

million barrels per day, up from January 2002, when

demand was about 18.5 million barrels per day, = 777 million

gallons. If lined up in 1-gallon cans, they

would encircle the earth at the equator almost 6 times

(about 147,000 miles of cans) — every day.

Here's another image: EVERY DAY, the US consumes enough

oil to cover a football field with a column of oil 2500

feet tall. That's 121 million cubic feet. 55-60% of US

consumption is imported at a cost of $50 billion+ per year,

amounting to the largest single element of our trade

deficit. In summer 2004, thanks to higher prices,

increased demand, and lower production, record trade

deficits of more than $50 billion per month were recorded,

with approximately 30% of that attributable to imported

energy costs. In September 2004, the US reported its lowest

monthly oil production in 55 years, at an average of

4.85 million barrels per day. US OIL

DEMAND, 2004: Over 20

million barrels per day, up from January 2002, when

demand was about 18.5 million barrels per day, = 777 million

gallons. If lined up in 1-gallon cans, they

would encircle the earth at the equator almost 6 times

(about 147,000 miles of cans) — every day.

Here's another image: EVERY DAY, the US consumes enough

oil to cover a football field with a column of oil 2500

feet tall. That's 121 million cubic feet. 55-60% of US

consumption is imported at a cost of $50 billion+ per year,

amounting to the largest single element of our trade

deficit. In summer 2004, thanks to higher prices,

increased demand, and lower production, record trade

deficits of more than $50 billion per month were recorded,

with approximately 30% of that attributable to imported

energy costs. In September 2004, the US reported its lowest

monthly oil production in 55 years, at an average of

4.85 million barrels per day.

US demand for

natural gas is increasing, and production in many long-time

prime producing areas (e.g. the Gulf Coast) is diminishing

to the point of near-total depletion. Without

significant increases in drilling (well beyond anticipated

levels), demand is predicted to significantly exceed supply

soon. By 2000, US demand (22.2 tcf/year) exceeded

production (18.7 tcf/year) enough that about 14% of our

natural gas was being imported from Canada. This may

provide a window of opportunity for explorationists and

producers (especially smaller operators), and may improve

the domestic market for geoscientists. Note that it is

currently impossible (without complex liquification) to

transport natural gas across oceans -- so huge gas reserves

in the Nile Delta, for example, are irrelevant to US needs. US demand for

natural gas is increasing, and production in many long-time

prime producing areas (e.g. the Gulf Coast) is diminishing

to the point of near-total depletion. Without

significant increases in drilling (well beyond anticipated

levels), demand is predicted to significantly exceed supply

soon. By 2000, US demand (22.2 tcf/year) exceeded

production (18.7 tcf/year) enough that about 14% of our

natural gas was being imported from Canada. This may

provide a window of opportunity for explorationists and

producers (especially smaller operators), and may improve

the domestic market for geoscientists. Note that it is

currently impossible (without complex liquification) to

transport natural gas across oceans -- so huge gas reserves

in the Nile Delta, for example, are irrelevant to US needs.

UPDATE:

Hiring of newly graduated geoscientists has increased

dramatically in Fall 1996. FURTHER UPDATE: The "boomlet" of

1996-97 became the bust of 1998, when the price of oil fell

to below $10.00 per barrel, and thousands were laid off. By

late 1999, things were looking up again. The short-term of

the cycle swings is taking many people by surprise. For much

of 2000-2002, prices have been fairly stable in the $20s per

barrel.

US PRODUCTION, early 2002: About

5.9 million barrels of oil per day, plus about 2 million

barrels of natural gas liquids and condensate; and 55

billion cubic feet of gas per day. Oil production is a

decline from 8-9 million b/d in 1986.

US PRODUCTION, early 2002: About

5.9 million barrels of oil per day, plus about 2 million

barrels of natural gas liquids and condensate; and 55

billion cubic feet of gas per day. Oil production is a

decline from 8-9 million b/d in 1986.

World's other largest producers: Former

USSR (once the world's largest producer) production

has declined more than 30% since 1988, from more than 12 to

about 8 million barrels per day. Saudi Arabia produces

about 5 to 9 million barrels per day (7.3 million in early

2002; production depends more on OPEC quotas and prices than

on real capability).

World's other largest producers: Former

USSR (once the world's largest producer) production

has declined more than 30% since 1988, from more than 12 to

about 8 million barrels per day. Saudi Arabia produces

about 5 to 9 million barrels per day (7.3 million in early

2002; production depends more on OPEC quotas and prices than

on real capability).

US Production capacity, about 8

million barrels per day, is accomplished with about 533,000

oil wells, averaging less than 17 barrels per well per

day. Saudi capacity, similar at about 8-9 million

barrels per day, is from 750 wells — averaging more

than 12,000 barrels per well per day. The best well in the

onshore 48 states is in Grant Canyon Field, Nevada,

producing about 4000 barrels per day from sucrosic Devonian

dolomites in a small fault block. UPDATE: 1997

discoveries in the Williston Basin are producing up to 6,000

barrels per day from Mississippian Lodgepole carbonate

mounds.

These are the best

wells in the onshore 48 states in decades -- but the

Gulf

of Mexico is the US hot

spot for current exploration and production.

US Production capacity, about 8

million barrels per day, is accomplished with about 533,000

oil wells, averaging less than 17 barrels per well per

day. Saudi capacity, similar at about 8-9 million

barrels per day, is from 750 wells — averaging more

than 12,000 barrels per well per day. The best well in the

onshore 48 states is in Grant Canyon Field, Nevada,

producing about 4000 barrels per day from sucrosic Devonian

dolomites in a small fault block. UPDATE: 1997

discoveries in the Williston Basin are producing up to 6,000

barrels per day from Mississippian Lodgepole carbonate

mounds.

These are the best

wells in the onshore 48 states in decades -- but the

Gulf

of Mexico is the US hot

spot for current exploration and production.

Oil and Gas are

used for much more than fuel. Every time you brush your

teeth (nylon bristles), drink milk or soda from a plastic

container, or play a plastic CD, Oil and Gas are

used for much more than fuel. Every time you brush your

teeth (nylon bristles), drink milk or soda from a plastic

container, or play a plastic CD,

And let's not forget that 57% of the US's

electricity is still generated by burning coal -- although

almost all of the rest comes from burning oil or gas.

In terms of total US energy

usage, the breakdown by source is given in the following table

(for late 2001):

| Energy Source |

Percentage of total |

| Petroleum |

42%

|

| Coal |

24%

|

| Natural Gas |

20%

|

| Nuclear |

8%

|

| Hydro power |

2%

|

| Solar, Wind, etc. |

2%

|

In contrast to US

usage, France obtains about 75% of its electricity supply from

nuclear energy sources.

The US oil industry lost

more than 1,000,000 jobs from 1986-92, more than the

more-publicized auto and steel industries combined.

The US oil industry lost

more than 1,000,000 jobs from 1986-92, more than the

more-publicized auto and steel industries combined.

Seven Sisters

& Standard Oil

The original Seven Sisters were

Exxon (or Esso, Humble, Standard of NJ), Shell, BP

(British Petroleum, originally Burmah Oil + Anglo-Iranian),

Gulf, Texaco, Mobil (Standard of NY, or

Socony-Vacuum), and Chevron (Standard of

California). Since Gulf Oil no longer exists (acquired by

Chevron in 1984) except as Gulf Canada and a marketing

company in the northeast US, Amoco (Standard of

Indiana) was often added to the list of six; but in 1998,

Amoco was acquired by BP to form BP Amoco, while Exxon was

acquiring Mobil; and Chevron and Texaco merged in 2001-2002.

The original Seven Sisters were

Exxon (or Esso, Humble, Standard of NJ), Shell, BP

(British Petroleum, originally Burmah Oil + Anglo-Iranian),

Gulf, Texaco, Mobil (Standard of NY, or

Socony-Vacuum), and Chevron (Standard of

California). Since Gulf Oil no longer exists (acquired by

Chevron in 1984) except as Gulf Canada and a marketing

company in the northeast US, Amoco (Standard of

Indiana) was often added to the list of six; but in 1998,

Amoco was acquired by BP to form BP Amoco, while Exxon was

acquiring Mobil; and Chevron and Texaco merged in 2001-2002.

LARGEST OIL COMPANIES

As noted above, Exxon and Mobil have

merged, and BP Amoco acquired ARCO. If I have counted

correctly, three

companies, BP Amoco, ExxonMobil, and ChevronTexaco,

combine within them no fewer than 14

of the 35 Standard Oil Trust companies that were divested

from Standard in 1911. For much more, and more

authoritative, information about Standard Oil and its

history, visit

"Whatever Happened to Standard Oil."

A 28-year oil price chart is given below. A 28-year oil price chart is given below.

(data from

Energy Information Administration, chart by Gibson Consulting)

OIL

In the history of the world,

according to AAPG presidential address, April 1993,

|

WORLD

PRODUCTION/CONSUMPTION: Production in

2000-2002 was about 75 million barrels

per day, about equal to the world

consumption of about 27 billion barrels

per year. Consumption is increasing at

a faster rate than the increase in

production.

WORLD

PRODUCTION/CONSUMPTION: Production in

2000-2002 was about 75 million barrels

per day, about equal to the world

consumption of about 27 billion barrels

per year. Consumption is increasing at

a faster rate than the increase in

production.

20

largest oil producers as of July 1999, in

million barrels per day:

20

largest oil producers as of July 1999, in

million barrels per day:

(source: mostly Oil & Gas Journal, World

Oil, and EIA; for 2002, includes condensate

& natural gas liquids, which explains

the apparent jump in US production. USA

still produces about 5.9 mb/d oil.)

|

20 largest oil

producers

| Country |

Production |

Rank & Production

Early 2002 |

1. Saudi Arabia 1. Saudi Arabia |

7.7 million barrels/day |

3. 7.7 mb/d |

2. Former Soviet Union 2. Former Soviet Union |

7.1 million barrels/day |

1. 8.6 mb/d |

3. USA 3. USA |

5.9 million barrels/day |

2. 8.1 mb/d |

4. Iran 4. Iran |

3.6 million barrels/day |

4. 3.7 mb/d |

5. China 5. China |

3.2 million barrels/day |

7. 3.3 mb/d |

6. Norway 6. Norway |

3.0 million barrels/day |

6. 3.4 mb/d |

7. Mexico 7. Mexico |

3.0 million barrels/day |

5. 3.6 mb/d |

8. Venezuela 8. Venezuela |

2.8 million barrels/day |

8. 2.8 mb/d |

9. United Kingdom 9. United Kingdom |

2.7 million barrels/day |

10. 2.6 mb/d |

10. Iraq 10. Iraq |

2.5 million barrels/day |

11. 2.4 mb/d |

11. United Arab Emirates 11. United Arab Emirates |

2.1 million barrels/day |

12. 2.2 mb/d |

12. Nigeria 12. Nigeria |

2.0 million barrels/day |

13. 2.1 mb/d |

13. Kuwait 13. Kuwait |

1.9 million barrels/day |

14. 1.7 mb/d |

14. Canada 14. Canada |

1.9 million barrels/day |

9. 2.8 mb/d |

15. Libya 15. Libya |

1.3 million barrels/day |

16. 1.4 mb/d |

16. Indonesia 16. Indonesia |

1.3 million barrels/day |

17. 1.2 mb/d |

17. Brazil 17. Brazil |

1.1 million barrels/day |

15. 1.6 mb/d |

18. Oman 18. Oman |

0.9 million barrels/day |

18. 1.0 mb/d |

19. Egypt 19. Egypt |

0.9 million barrels/day |

21. 0.75 mb/d |

20. Colombia 20. Colombia |

0.8 million barrels/day |

29. 0.62 mb/d |

In 1996, the USA was the world's leading producer, with

about 7.5 million barrels per day.

In 1996, the USA was the world's leading producer, with

about 7.5 million barrels per day.

Note: Former Soviet Union production has dropped from the highest

in the world, at around 12 million b/d in the late

1980s, but it has stabilized since 1993 and began to

increase significantly by 1998. 86% of "former Soviet Union"

production is from Russia, with Kazakstan at 7% and

Azerbaijan at 3%.

Note: Former Soviet Union production has dropped from the highest

in the world, at around 12 million b/d in the late

1980s, but it has stabilized since 1993 and began to

increase significantly by 1998. 86% of "former Soviet Union"

production is from Russia, with Kazakstan at 7% and

Azerbaijan at 3%.

The 20 countries on this list produce about 57 million b/d,

about 87% of world production. OPEC countries

account for about 24 million b/d, or 40% of world

production.

The 20 countries on this list produce about 57 million b/d,

about 87% of world production. OPEC countries

account for about 24 million b/d, or 40% of world

production.

Are you surprised to see Norway so high on this list?

There are very few sedimentary rocks onshore Norway. All of

this production comes from offshore, in the North Sea.

Are you surprised to see Norway so high on this list?

There are very few sedimentary rocks onshore Norway. All of

this production comes from offshore, in the North Sea.

|

Texas

contains/contained about 15 billion barrels

(East Texas Field, at about 5 billion, is the

largest field in the 48 states. It is a

regional stratigraphic trap in Upper

Cretaceous fluvio-deltaic sandstones.)

Texas

contains/contained about 15 billion barrels

(East Texas Field, at about 5 billion, is the

largest field in the 48 states. It is a

regional stratigraphic trap in Upper

Cretaceous fluvio-deltaic sandstones.)

Prudhoe Bay = about 9-10

billion barrels. It is a broad culmination on

the Barrow Arch, and the reservoirs are

transgressive marine to non-marine

conglomerates and sandstones of Triassic age.

The reservoir contains a lot of gas, too. Prudhoe Bay = about 9-10

billion barrels. It is a broad culmination on

the Barrow Arch, and the reservoirs are

transgressive marine to non-marine

conglomerates and sandstones of Triassic age.

The reservoir contains a lot of gas, too.

|

|

The following table is based on various sources

and is as accurate as I could make it. It

represents CUMULATIVE production, not

current production, PLUS estimated reserves, so

it is a measure of all the oil that was/is

contained in the fields. Some, such as most of

the California fields, have been producing since

the 1930s and are significantly depleted. Most

(more than 10 billion barrels) of Prudhoe Bay's

oil has been produced. |

10 largest oil

fields in the US

| Field, State |

Cumulative Production

+ Est. Reserves |

1. Prudhoe Bay, Alaska 1. Prudhoe Bay, Alaska |

10+ billion barrels |

2. East Texas 2. East Texas |

6.0 billion barrels |

3. Wilmington, California 3. Wilmington, California |

2.8 billion barrels |

4. Midway-Sunset,

California 4. Midway-Sunset,

California |

2.2 billion barrels |

5. Kern River, California 5. Kern River, California |

1.95 billion barrels |

6. Yates, West Texas 6. Yates, West Texas |

1.95 billion barrels |

7. Wasson, Texas 7. Wasson, Texas |

1.8 billion barrels |

8. Elk Hills, California 8. Elk Hills, California |

1.5 billion barrels |

9. Kuparuk River, Alaska 9. Kuparuk River, Alaska |

1.5 billion barrels |

10. Panhandle, Texas 10. Panhandle, Texas |

1.4 billion barrels |

|

The largest

oil field in the world (Ghawar in Saudi

Arabia) contains an estimated ultimate

recoverable 75 billion barrels of oil, or

more than seven times Prudhoe Bay, in Upper

Jurassic shallow-water carbonates in a broad

anticline.

The largest

oil field in the world (Ghawar in Saudi

Arabia) contains an estimated ultimate

recoverable 75 billion barrels of oil, or

more than seven times Prudhoe Bay, in Upper

Jurassic shallow-water carbonates in a broad

anticline.

Chevron is working

with Kazakstan and others to develop the

huge Tengiz field near the Caspian

Sea (estimates run from 15 to 26 billion

barrels recoverable, from what amounts to an

oil-filled paleo-atoll, or reef) with a goal

of producing about 700,000 barrels per

day from this one field -- equal to

more than 10% of the oil production of the

entire United States. Chevron is working

with Kazakstan and others to develop the

huge Tengiz field near the Caspian

Sea (estimates run from 15 to 26 billion

barrels recoverable, from what amounts to an

oil-filled paleo-atoll, or reef) with a goal

of producing about 700,000 barrels per

day from this one field -- equal to

more than 10% of the oil production of the

entire United States.

|

|

Numbers in the following table are mostly

ranges for estimated ultimate recoverable

reserves. Sometimes you see larger numbers

that represent original oil in place -- all of

which cannot be produced. Some of the fields

in this list are essentially completely

depleted (e.g., Romashkino). |

21 largest

oil fields

in the World

| Field, Country |

Size estimate |

1. Ghawar, Saudi Arabia 1. Ghawar, Saudi Arabia |

75-83 billion barrels |

2. Burgan, Kuwait 2. Burgan, Kuwait |

66-72 billion barrels |

3. Bolivar Coastal,

Venezuela 3. Bolivar Coastal,

Venezuela |

30-32 billion barrels |

4. Safaniya-Khafji,

Saudi Arabia/Neutral Zone 4. Safaniya-Khafji,

Saudi Arabia/Neutral Zone |

30 billion barrels |

5. Rumaila, Iraq 5. Rumaila, Iraq |

20 billion barrels |

6. Tengiz, Kazakstan 6. Tengiz, Kazakstan |

15-26 billion barrels |

7. Ahwaz, Iran 7. Ahwaz, Iran |

17 billion barrels |

8. Kirkuk, Iraq 8. Kirkuk, Iraq |

16 billion barrels |

9. Marun, Iran 9. Marun, Iran |

16 billion barrels |

10. Gachsaran, Iran 10. Gachsaran, Iran |

15 billion barrels |

11. Aghajari, Iran 11. Aghajari, Iran |

14 billion barrels |

12. Samotlor, West

Siberia, Russia 12. Samotlor, West

Siberia, Russia |

14-16 billion barrels |

13. Abqaiq, Saudi

Arabia 13. Abqaiq, Saudi

Arabia |

12 billion barrels |

14. Romashkino,

Volga-Ural, Russia 14. Romashkino,

Volga-Ural, Russia |

12-14 billion barrels |

15. Chicontepec, Mexico 15. Chicontepec, Mexico |

12 billion barrels |

16. Berri, Saudi Arabia 16. Berri, Saudi Arabia |

12 billion barrels |

17. Zakum, Abu Dhabi,

UAE 17. Zakum, Abu Dhabi,

UAE |

12 billion barrels |

18. Manifa, Saudi

Arabia 18. Manifa, Saudi

Arabia |

11 billion barrels |

19. Faroozan-Marjan,

Saudi Arabia/Iran 19. Faroozan-Marjan,

Saudi Arabia/Iran |

10 billion barrels |

20. Marlim, Campos,

Brazil 20. Marlim, Campos,

Brazil |

10-14 billion barrels |

21.Prudhoe Bay, Alaska,

USA 21.Prudhoe Bay, Alaska,

USA |

9.9 billion barrels |

Natural Gas

The largest gas fields in

the world are in the West Siberian

Basin (including Urengoy, Yamburg,

Zapolyarnoye), and contain more gas (well

over 1200 trillion cubic feet for

the whole basin) than in all the known gas

fields in the US, including Alaska (the US

has a lot of additional gas associated

with oil fields). Reservoirs are

Cretaceous fluvial clastics in drape

anticlines above Triassic-Jurassic horsts.

The largest gas fields in

the world are in the West Siberian

Basin (including Urengoy, Yamburg,

Zapolyarnoye), and contain more gas (well

over 1200 trillion cubic feet for

the whole basin) than in all the known gas

fields in the US, including Alaska (the US

has a lot of additional gas associated

with oil fields). Reservoirs are

Cretaceous fluvial clastics in drape

anticlines above Triassic-Jurassic horsts.

|

|

The

following table shows estimated proved

gas reserves for the top 12

countries. Numbers for gas reserves may be

misleading, as they may or may not include

"associated" gas (as in associated with

oil fields). Other estimates, for example,

put Canada much higher on the list. Source

for both of the following tables is mostly

the US Energy Information

Administration, which has a very useful web

site for statistics. |

12 top

natural gas countries

(by reserves)

| Country |

Reserve estimate |

World World |

4,980 trillion cubic feet |

1. Russia 1. Russia |

1,748 trillion cubic feet |

2. USA 2. USA |

1,475 trillion cubic feet |

3. Iran 3. Iran |

742 trillion cubic feet |

4. Qatar 4. Qatar |

245 trillion cubic feet |

5. Abu Dhabi 5. Abu Dhabi |

188 trillion cubic feet |

6. Saudi Arabia 6. Saudi Arabia |

185 trillion cubic feet |

7. Venezuela 7. Venezuela |

140 (maybe 450) trillion

cubic feet |

8. Algeria 8. Algeria |

128 trillion cubic feet |

9. Turkmenistan 9. Turkmenistan |

100 (maybe 535) trillion

cubic feet |

10. Kazakstan 10. Kazakstan |

83 trillion cubic feet |

11. Canada 11. Canada |

67 trillion cubic feet |

12. Uzbekistan 12. Uzbekistan |

60 trillion cubic feet |

| Specific

values for gas field sizes are even harder

to pin down. The following list is not

necessarily in exact order and would

change with other estimators; it is not

perfectly clear in each case whether

cumulative production or estimated

remaining reserves is meant. There are

some 20 fields in West Siberia that exceed

35 TCF each. Use this table as a

starting point. Numbers are in

trillion cubic feet (TCF) and should be

viewed as ball-park figures. |

22 largest natural gas fields

in the World

| Field, Country |

Size estimate |

1. Urengoy, West

Siberia, Russia 1. Urengoy, West

Siberia, Russia |

>275 trillion cubic

feet |

2. Yamburg, West

Siberia, Russia 2. Yamburg, West

Siberia, Russia |

prob. >200 trillion

cubic feet |

3. Orenburg, Volga

Region, Russia 3. Orenburg, Volga

Region, Russia |

prob. >200 trillion

cubic feet |

4. Schtockmanov,

Barents Sea, Russia 4. Schtockmanov,

Barents Sea, Russia |

prob. >200 trillion

cubic feet |

5. North Dome,

Qatar 5. North Dome,

Qatar |

241 trillion cubic feet |

6. Umm Shaif + Abu

el-Bukush, Abu Dhabi 6. Umm Shaif + Abu

el-Bukush, Abu Dhabi |

175 trillion cubic feet |

7. Zapolyarnoye,

West Siberia, Russia 7. Zapolyarnoye,

West Siberia, Russia |

150+ trillion cubic feet |

8. Kharasevey, West

Siberia, Russia 8. Kharasevey, West

Siberia, Russia |

150+ trillion cubic feet |

9. Bovanenko, West

Siberia, Russia 9. Bovanenko, West

Siberia, Russia |

125 trillion cubic feet |

10. Medvezh'ye,

West Siberia, Russia 10. Medvezh'ye,

West Siberia, Russia |

100+ trillion cubic feet |

11. Hassi R'Mel,

Algeria 11. Hassi R'Mel,

Algeria |

100 trillion cubic feet |

12. South Pars,

Iran 12. South Pars,

Iran |

100 trillion cubic feet |

13.

Panhandle-Hugoton, USA (TX-OK-KS) 13.

Panhandle-Hugoton, USA (TX-OK-KS) |

80 trillion cubic feet |

14. Groningen,

Netherlands 14. Groningen,

Netherlands |

66 trillion cubic feet |

15. Ghawar Oil

Field, Saudi Arabia 15. Ghawar Oil

Field, Saudi Arabia |

60 trillion cubic feet |

16. North Pars,

Iran 16. North Pars,

Iran |

48 trillion cubic feet |

17.

Dauletabad-Donmez, Turkmenistan 17.

Dauletabad-Donmez, Turkmenistan |

47 trillion cubic feet |

18. Karachaganak,

Kazakstan 18. Karachaganak,

Kazakstan |

46 trillion cubic feet |

19. Shatlyk,

Turkmenistan 19. Shatlyk,

Turkmenistan |

35 trillion cubic feet |

20. Yashlar,

Turkmenistan 20. Yashlar,

Turkmenistan |

27 trillion cubic feet |

21. Blanco (San

Juan), USA (NM) 21. Blanco (San

Juan), USA (NM) |

23 trillion cubic feet |

22. Gazli,

Uzbekistan 22. Gazli,

Uzbekistan |

20 trillion cubic feet |

USA

|

In the U.S.,

about 35% of oil and gas

production comes from reservoirs

of Tertiary age (largely in the

Gulf Coast and California);

about 25% is from

reservoirs of Pennsylvanian age

(West Texas, Rockies,

Midcontinent), and about 12%

is from reservoirs of Cretaceous

age. Sandstone reservoirs

account for 70% of

fields; limestone = 16%;

dolomite = 11%.

In the U.S.,

about 35% of oil and gas

production comes from reservoirs

of Tertiary age (largely in the

Gulf Coast and California);

about 25% is from

reservoirs of Pennsylvanian age

(West Texas, Rockies,

Midcontinent), and about 12%

is from reservoirs of Cretaceous

age. Sandstone reservoirs

account for 70% of

fields; limestone = 16%;

dolomite = 11%.

The Offshore

US Gulf of Mexico has

become one of the "hottest"

exploration areas in the world,

just a few years after many had

declared it the "Dead Sea" for

exploration potential. Dramatic

improvements in 3-D Seismic

technology (increasing

success rates to as much as 80%,

up from less than 40%) and

deepwater drilling methodology

are largely the basis for this

resurgence. And several very

nice discoveries have not hurt

one bit. Reserves in discovered

deep-water (>500 meters)

fields alone are estimated at

nearly 1.5 billion barrels,

with two fields (Shell's Mars

and BP's Crazy Horse, renamed

Thunder Horse) at about

100,000,000 barrels or more. The Offshore

US Gulf of Mexico has

become one of the "hottest"

exploration areas in the world,

just a few years after many had

declared it the "Dead Sea" for

exploration potential. Dramatic

improvements in 3-D Seismic

technology (increasing

success rates to as much as 80%,

up from less than 40%) and

deepwater drilling methodology

are largely the basis for this

resurgence. And several very

nice discoveries have not hurt

one bit. Reserves in discovered

deep-water (>500 meters)

fields alone are estimated at

nearly 1.5 billion barrels,

with two fields (Shell's Mars

and BP's Crazy Horse, renamed

Thunder Horse) at about

100,000,000 barrels or more.

The top

ten producing states by current

(early 2002) daily production are

Louisiana, Texas, Alaska,

California, New Mexico,

Oklahoma, Wyoming, Kansas, North

Dakota, and Mississippi.

Illinois is not a present-day big

producer, but until about 1970,

Illinois was the 4th largest

cumulative producer of oil (after

TX, LA, and OK). The top

ten producing states by current

(early 2002) daily production are

Louisiana, Texas, Alaska,

California, New Mexico,

Oklahoma, Wyoming, Kansas, North

Dakota, and Mississippi.

Illinois is not a present-day big

producer, but until about 1970,

Illinois was the 4th largest

cumulative producer of oil (after

TX, LA, and OK).

IN 1994,

U.S. OIL IMPORTS EXCEEDED

50% OF CONSUMPTION FOR THE

FIRST TIME. In 1999, US

imports were about 11

million barrels per day,

compared to our domestic

production of 6 million

barrels per day. You do the

math.

IN 1994,

U.S. OIL IMPORTS EXCEEDED

50% OF CONSUMPTION FOR THE

FIRST TIME. In 1999, US

imports were about 11

million barrels per day,

compared to our domestic

production of 6 million

barrels per day. You do the

math.

|

SOURCES OF

US OIL IMPORTS

|

The

Map below is based on data from

Energy Information Administration

for December, 1999. Note that the

"Big Four"—Saudi Arabia, Canada,

Mexico, and Venezuela—alternate

their ranks fairly often. Some

months Venezuela is No. 1,

sometimes it is Canada. Something

like 15% of our imports come from

each of these countries. (Note: on

the map, 250 million barrels and

54% refer to our total imports,

including the 10% that comes from

countries not indicated, such as

Kuwait, Algeria, the United Arab

Emirates, and Indonesia.)

|

|

One

barrel of crude oil makes about

19½ gallons of gasoline, 9 gallons

of fuel oil, 4 gallons of jet

fuel, and 11 gallons of other

products, including lubricants,

kerosene, asphalt, and

petrochemical feedstocks to make

plastics. The ultimate cost of a

gallon of gas at the service

station depends mostly on the

price of crude oil, and most of

the profit after expenses goes to

the owner-producers of the oil,

whether they are governments or

oil producing companies. The

following table shows an

approximate breakdown of the costs

that go into a gallon of gas in

the US. Almost everywhere in the

world outside the US, people pay

MUCH more for gasoline, largely

because of much larger government

taxes, which amount to around $3

to $4 per gallon in many European

countries. In the categories

"Production cost" and "Producer

profit" the values show a range

from Saudi Arabian production to

USA production. Naturally, all the

other values may vary some as

well; these are general estimates.

|

Costs to

produce and sell a gallon of gasoline in the

US

| Expense |

Amount |

Production

cost Production

cost |

15¢ to 60¢ |

Producer

profit Producer

profit |

53¢ to 8¢ |

Refining cost Refining cost |

13¢ |

Marketing

cost Marketing

cost |

5¢ |

Transportation

cost Transportation

cost |

15¢ |

Retailer cost Retailer cost |

6¢ |

Refiner,

marketer, Refiner,

marketer,

transp. & retailer profit |

10¢ |

US Taxes US Taxes |

19¢ |

Average state

taxes Average state

taxes |

23¢ |

TOTAL TOTAL |

$1.59 |

|

If

you're paying less than $1.59,

it probably means that the

independent gas dealer on the

corner is only getting a profit

of 1¢ or 2¢ a gallon rather than

the 5¢ or 6¢ average, or else

the price of oil has gone down

and the owner-producers' profits

are less. A higher cost may mean

it is summer, when special

refining is required for

oxygenated fuels, and it costs

more to produce more for

increased demand.

|

Thanks to

Dick Gibson

Gibson

Consulting, 301 N. Crystal St., Butte, MT

59701

E-mail your questions

and comments

|

![]()